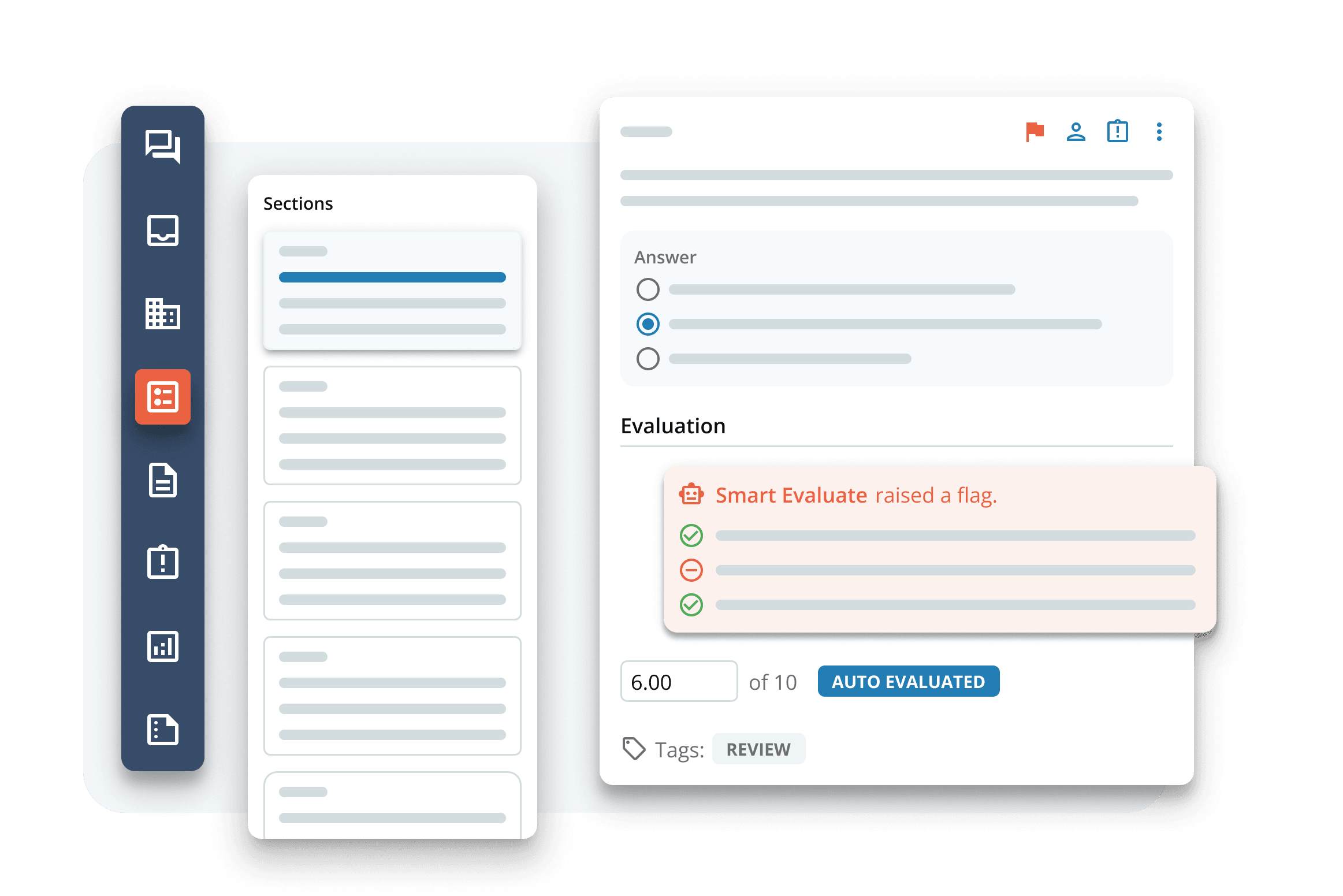

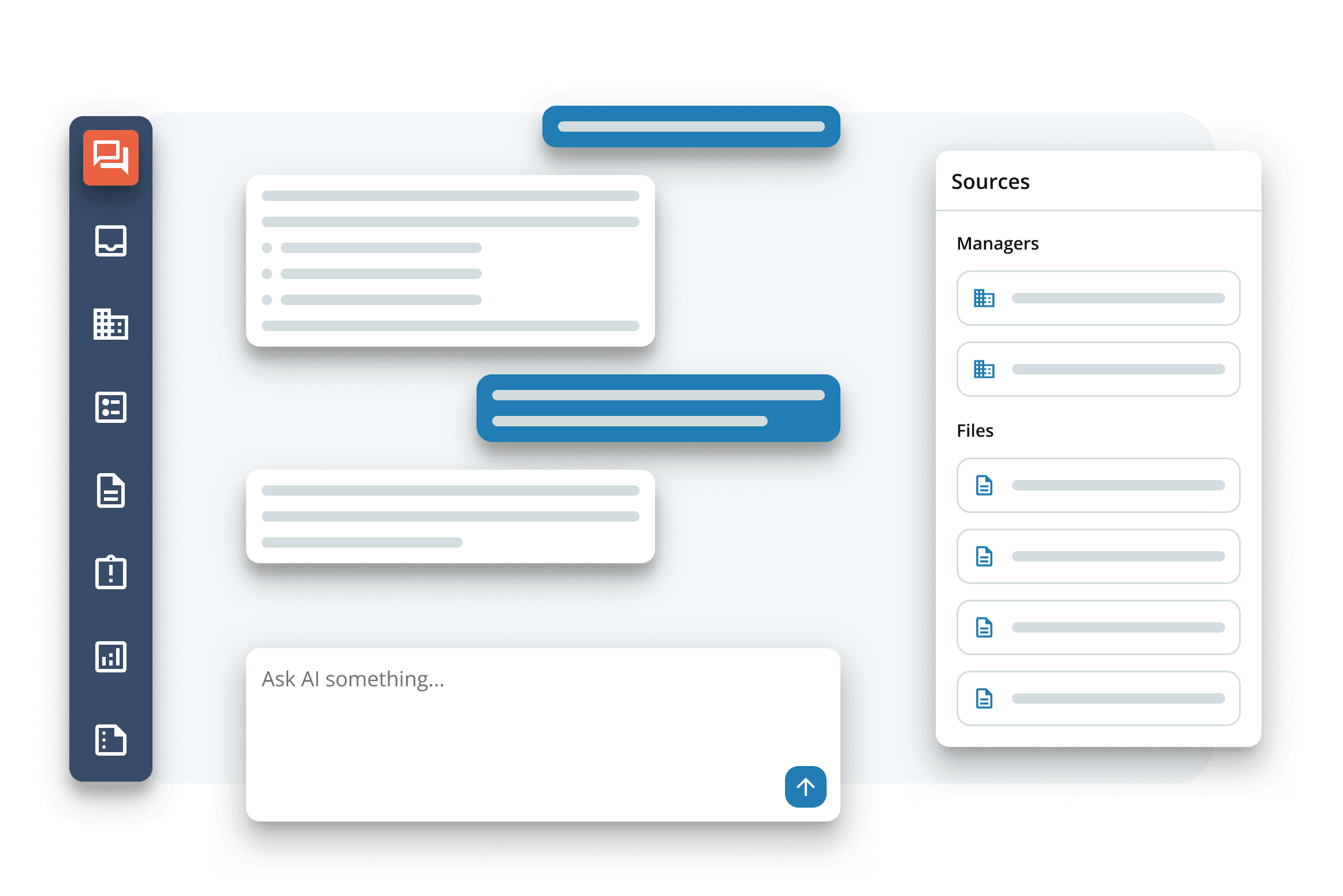

CentrlGPT is a first-of-its-kind agentic AI solution that transforms risk and diligence processes by leveraging proprietary LLMs to deliver unprecedented intelligence, efficiency, and rigor. Integrated into DD360, it automates labor-intensive evaluation steps, freeing analysts to focus on higher-value initiatives, while AI-powered tools like the Report Builder and Research Assistant convert traditional questionnaire data into actionable intelligence. By extracting organized outputs from both structured and unstructured data, firms can identify trends, surface anomalies, compare managers, and generate insights for investment committees, executive briefings, and portfolio reviews—turning static data into strategic intelligence that drives scalability, oversight, and faster decision-making.

The Diligence Platform for the Investment Management Industry

CENTRL’s DD360 is the most comprehensive AI powered due diligence platform for asset owners and allocators. DD360 brings dramatic efficiency to your due diligence processes. With the power of agentic AI, DD360 unlocks efficiency, reduces risk, and drives greater insight from your data.

DD360 powered by CentrlGPT

Due Diligence Platform For Asset Owners and Allocators

- The Most Powerful Automation in the Industry

- Domain-specific, designed for the Investment Management Industry

- A Single Source of Truth

- Deep Analytics and Reporting

- Strategic Insights and Intelligence

- Designed to Bring Dramatic Efficiency Improvements

- Advanced Reporting Features

No need to take our word for it

Resources

CENTRL Announces New AI-Powered Reporting & Research Assistant To Provide Greater Insights For Better Decision Making

CENTRL launched its new AI-powered Guided Report Builder and Interactive Research Assistant, designed to transform due diligence data into actionable intelligence for faster, more informed decision-making. The release enables firms to uncover trends, detect anomalies, compare managers, and generate board-ready reports and executive summaries with ease. By centralizing data and delivering real-time insights, CENTRL equips investment, risk, and compliance teams to collaborate more effectively, scale efficiently, and enhance oversight.

The Future of DDQ/RFP Responses in Asset Management: Why Change is Inevitable

The rising complexity of DDQs and RFPs has exposed the limits of outdated, manual response processes and generic drafting tools. Asset managers face three persistent challenges—keeping answer libraries current, digitizing non-standard questionnaires, and ensuring compliance-approved, consistent responses. To overcome these bottlenecks, the next generation of platforms must deliver agentic, domain-trained intelligence with dynamic content libraries, advanced ingestion tools, and compliance-first workflows, transforming diligence into a competitive advantage rather than a burden.

CENTRL and AIMA: Leveraging AI to Transform Client and Prospect Communication

This webinar examines how AI is transforming communication between managers and clients, particularly in alternative and private asset management, where delivering direct, personalized insights is essential. AI not only reduces costs and enhances efficiency but also drives growth and improves ROI.