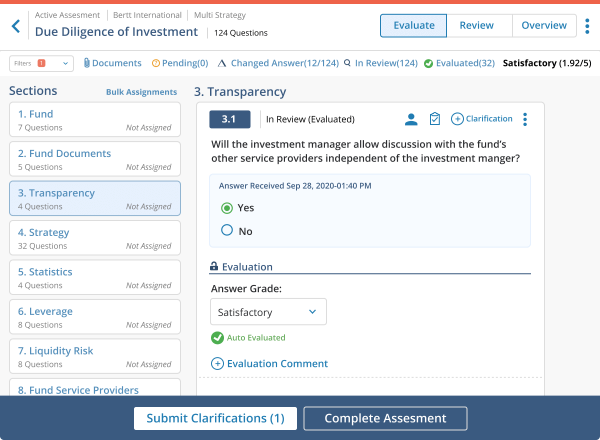

CentrlGPT is the first of its kind generative AI solution that revolutionizes risk and diligence processes. CentrlGPT offers users unprecedented intelligence and power by leveraging proprietary LLMs to enhance the efficiency and rigor of risk in diligence processes. DD360 powered by CentrlGPT, takes on laborious manual evaluation steps of the due diligence process by applying AI to free up valuable time for analysts to focus on higher value initiatives.

The Diligence Platform for the Investment Management Industry

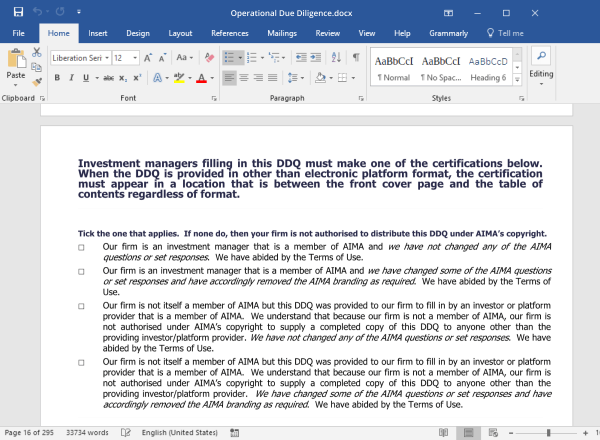

CENTRL’s DD360 is the most comprehensive AI powered due diligence platform used today by leading investors, managers, and consultants. DD360 brings dramatic efficiency to your due diligence processes. With the power of generative AI, DD360 acts as a virtual copilot for risk analysts, significantly reducing the need for manual tasks. Unlock efficiency, reduce risk, and act with greater insight.

Trusted by

DD360 powered by CentrlGPT

No need to take our word for it

Resources

WEBINAR ON DEMAND - Disruption in Due Diligence: How Generative AI Will Transform the Future

This is an exploration of the future of AI in external manager oversight and due diligence. Hear how you can transform risk evaluation through the systematic and consistent application of secure risk intelligence- at a scale, speed, and accuracy not possible until now.

CentrlGPT - Your AI-Powered Risk Copilot

CentrlGPT is the first of its kind generative AI solution for third-party risk and diligence. CentrlGPT leverages the power of Large Language Models to act as a risk copilot for your diligence teams, dramatically enhancing the efficiency and effectiveness of your risk process. CentrlGPT is designed as a secure enterprise solution to be trained with your custom risk models and implemented as a seamless extension of your current CENTRL platform.

How AI Transforms Risk Assessments Through the Systematic & Consistent Application of Risk Intelligence

Check out our latest blog on how AI transforms risk assessments through the systematic & consistent application of risk intelligence