A Strategic Shift Is Underway: Why Domain-Trained AI Is Driving Operational Alpha

By: Centrl Team

AI has moved from a speculative idea to a fundamental operational necessity. Today, the real source of alpha is operational leverage, utilizing intelligent automation to transform how data, workflows, and oversight operate across daily processes.

This shift is already happening at scale. Leading institutions are reclaiming tens of thousands of hours across client support, onboarding, and compliance. Functions once considered fixed cost centers (such as risk, data management, and monitoring) are becoming true competitive advantages.

Firms that delay modernization risk locking in higher costs, slower decision-making, and a weaker client experience. Those who treat AI as core infrastructure, and not a side experiment, will define the next several years of industry leadership.

Why Domain-Trained AI?

Generic AI tools can summarize documents and draft emails, but they are not where the real competitive advantage will come from.

The alpha will accrue to firms that deploy domain-trained AI: models built, tuned, and governed on financial-industry data, nomenclature, and workflows. These models understand the nuance of real-world investment and risk processes because they are trained on them.

Domain-trained AI drives alpha in several ways:

Higher accuracy, lower noise

Domain-specific models understand risk factors, regulatory language, DDQ/RFP patterns, operational controls, and asset-class nuances. That reduces “hallucinations,” misinterpretations, and off-target outputs that generic tools often produce. Fewer errors mean less rework and faster time-to-decision.

Contextual judgment, not just text generation

Agentic AI models don’t just read a policy; they understand how it ties to controls, evidence, and regulatory expectations. It can map a manager’s DDQ response to specific risk categories, flag gaps, and suggest follow-up questions. That’s not just efficiency; that’s better risk-adjusted decision-making.

Structured + unstructured integration

Investment and operational alpha increasingly depend on connecting structured data (AUM, flows, exposures, KPIs) with unstructured content (DDQs, financial statements, SOC reports, incident notifications). Domain-trained AI is built to bridge both, generating insights, not just excerpts.

Auditability and governance

Domain-trained AI solutions can be designed around clear data lineage, explainable reasoning steps, and evidence links, critical for regulators, clients, and internal audits. That directly impacts trust and adoption, which in turn drives scale.

Compounding knowledge over time

The more a model interacts with your specific firm, your funds, your risk framework, and your policies, the more it becomes a proprietary asset. Over time, it encodes institutional memory and best practices, giving you a compounding intelligence advantage that generic tools simply cannot match.

As markets become more competitive and more regulated, these factors translate into operational alpha first and, ultimately, investment and commercial alpha.

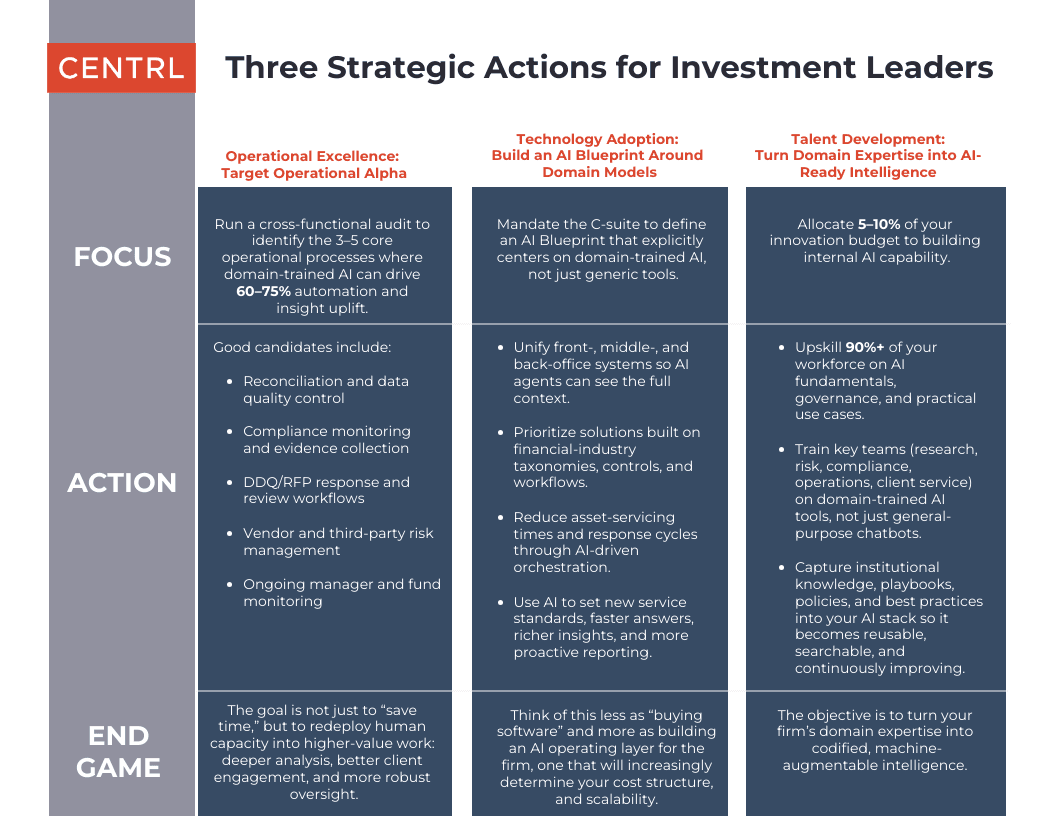

Implications for Investment Managers and Service Providers

Over the next decade, the largest AUM growth is likely to be driven less by “better stock picks” and more by AI-enabled operational excellence, especially for managers, banks, and service providers competing on sophistication, transparency, and responsiveness.

“Operational alpha”, the performance drag created by inefficient operations, is costing firms hundreds if not millions annually. Domain-trained AI is how that drag gets converted into a source of advantage.

AI agents and domain-tuned models can now

Autonomously manage data quality, lineage, and reconciliation across systems.

Streamline complex workflows such as DDQ review, compliance testing, KYC, and monitoring.

Enable real-time risk assessment, anomaly detection, and early-warning indicators.

Turn diligence data into decision-ready insights for ICs, boards, and clients.

The cost of manual oversight and fragmented data is becoming untenable. Only a small fraction of funds currently deploy AI deeply into compliance and oversight workflows, missing significant opportunities for both risk reduction and client differentiation.

At the same time, client expectations are rising. Allocators and regulators now expect:

Faster, more frequent, and more transparent reporting

Evidence-backed responses, not generic narratives

Consistency across every channel: RFPs, DDQs, reviews, and board materials

Domain-trained AI is uniquely suited to meet these expectations because it can operate within the language, structure, and governance standards of the industry.

The Talent Dimension: Human + Domain AI as the New Operating Model

Competitive advantage will increasingly flow to firms that attract, train, and retain AI-first, domain-fluent talent.

We’re already seeing signals:

Firms are training nearly their entire workforce on AI tooling and workflows

Banks are committing to an “AI assistant for every employee” as a strategic goal

Investment and operations teams rethinking job design around human + AI collaboration

In this model, domain-trained AI becomes the “second brain” for analysts, PMs, compliance officers, client service teams, and risk managers—surfacing insights, drafting outputs, triaging issues, and maintaining continuity across complex processes.

Generic AI can help write a memo. Domain-trained AI can help run the business.

The Bottom Line

AI will absolutely reshape portfolios, but the first value is going to be unlocked in operational due diligence and monitoring.

The firms that move quickly to deploy domain-trained AI solutions, not just generic tools, will redefine operational alpha, compress cost structures, accelerate decision cycles, and deliver a level of transparency and responsiveness that becomes nearly impossible to compete against.

Those who wait risk discovering that by the time AI shows up in performance attribution, the real game, in infrastructure, operations, and client experience, has already been decided.