Rethinking Communication in the Age of AI

Rethinking Communication in the Age of AI

In conversations with clients and peers across the alternatives industry, one theme always comes up. Everyone wants more information, delivered faster, in more formats, and with perfect accuracy. Yet most teams have less time and fewer people than ever to make that happen. The pressure is real, and it is changing the way firms communicate with investors, prospects, and partners.

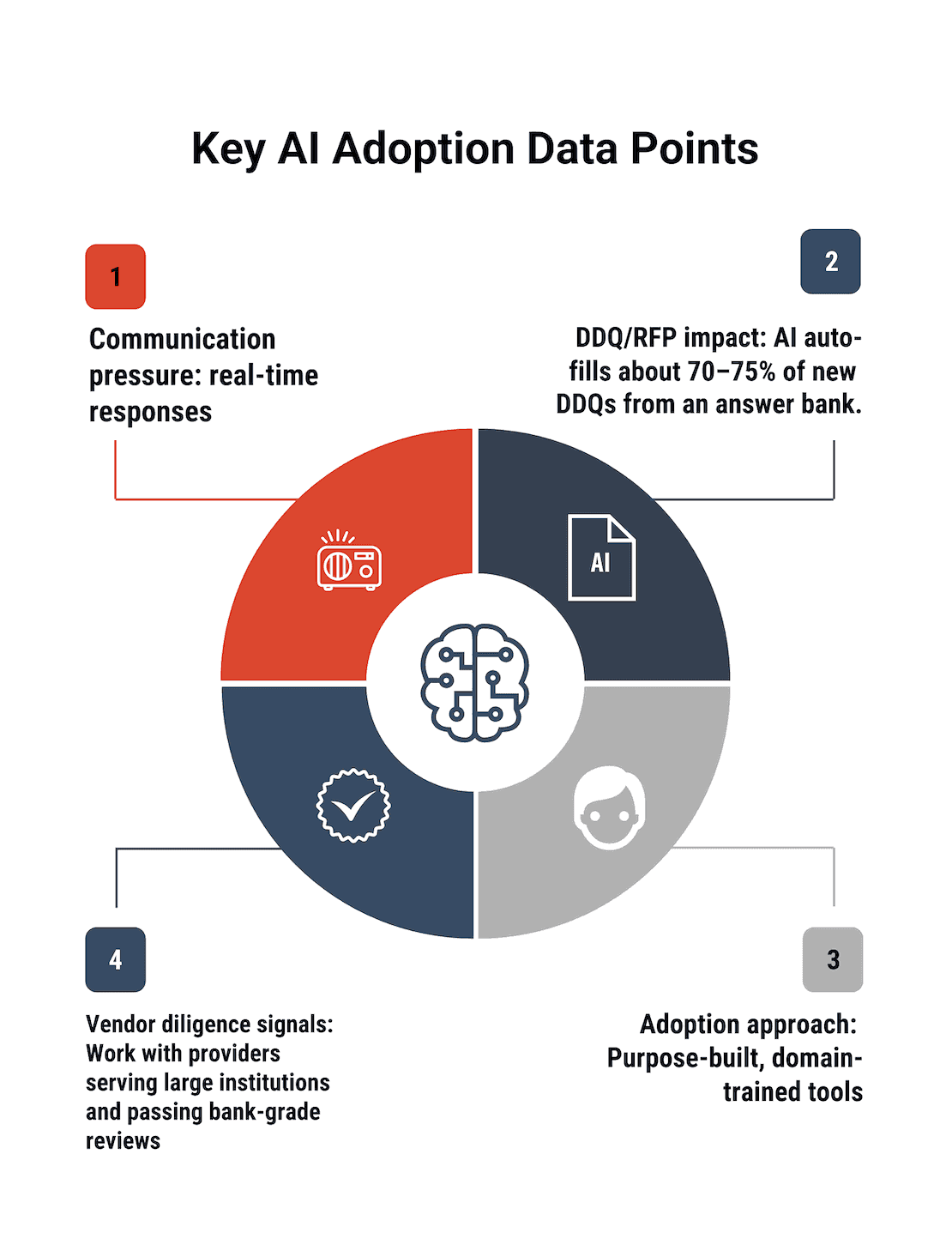

The demands are not just about volume. They are about accuracy, speed, context, and transparency. In private markets, expectations now mirror what investors have long expected and received in public markets. Allocators want near real-time responses that are clear, consistent, and data-driven. Regulators and consultants are also asking for more frequent updates and deeper explanations. The old cycle of quarterly letters and annual reports has given way to more of a continuous conversation where questions can come at any hour, and answers are expected promptly.

That shift has made communication a productivity problem as much as a marketing one. I often hear from managers who describe the daily task of “jigsaw-puzzling” data together just to respond to a single diligence question. The process is slow, manual, and often error-prone. It risks inconsistency and frustration on both sides. This is where artificial intelligence, used well, can make a meaningful difference.

Where AI Truly Helps

Generative AI has captured the world’s attention, but the real value for investment managers comes from how it can be applied to specific, repeatable workflows. When used to summarize information, draft responses, or retrieve answers from a trusted internal database, AI can save enormous amounts of time. It can transform tasks that once took days into something that takes hours.

The most practical starting point is due diligence response. Many firms now use systems that can automatically fill seventy percent or more of a DDQ or RFP using pre-approved language. Humans then step in to refine tone, confirm details, and add the most current data. The key to success here is maintaining an internal single source of truth and a structured, accurate repository of firm information that is continuously updated to avoid stale, irrelevant data. Without that foundation, automation simply spreads old errors faster.

I’ve also seen AI free up teams to think more creatively. When routine writing or research can be automated responsibly, time is released for deeper thinking, analysis, and relationship-building. The real benefit is not just speed, but focus. People can spend less time chasing numbers and more time deriving and communicating the insights surrounding those numbers.

Where It Doesn’t Replace People

Even the best models need human interaction and judgment. The “fast draft” can greatly enhance productivity, but it must be checked. In an industry built on trust, there is no substitute for accuracy and accountability. Every piece of communication that leaves a firm, whether an investor update or a fund-level disclosure, needs to be reviewed for nuance, tone, and potential errors.

There needs to be extraordinary precautions in place when dealing with client information and other personally identifiable data. It is critical that AI partners have world-class enterprise infosec capabilities and that data is never shared with external models. Reputation and data integrity are non-negotiable.

Choosing the Right Kind of AI

Not all AI tools are created equal. There is a big difference between general consumer models and domain-trained systems that understand the language and context of finance. A general model can write decent text, but it often lacks the ability to verify sources, interpret terms, or recognize the significance of small distinctions. In our world, those distinctions matter. The difference between an SEC exam and an investigation, or between a key-person event and routine turnover, can have material implications.

That is why vertical, purpose-built solutions tend to outperform when the stakes are high. They are trained on industry-specific data, operate within enterprise controls, and produce outputs in formats that align with how professionals actually communicate. They need to seamlessly integrate with all industry materials, including board decks, client letters, DDQ responses, and audit responses. They also maintain audit trails and security standards that meet institutional expectations. For managers who do not have the scale or technical resources to build this infrastructure internally, outsourcing to a proven platform is often the smarter path.

Adoption and Change Management

The hardest part of adopting new technology is not the technology itself; it is the change management. AI solutions must have tools to facilitate the onboarding to seamlessly transition from manual processes. Interestingly, AI tools can also be utilized for this matching process. Tools also fail when people do not trust or understand them, so demonstrated success with measurable outcomes can instill confidence to leap. We have noticed a dramatic shift in openness and willingness to consider AI solutions. The market is realizing the power, as well as the competitive imperative and inevitability of these solutions.

I usually suggest three guiding principles. First, begin with a clear, narrow use case where the benefits are easy to measure. A real example might be automating RFP responses or creating a searchable internal FAQ. Second, establish ownership and accountability. Someone needs to maintain the source data and oversee updates. Third, define a review path that keeps compliance and business owners involved so that quality never slips. Once those foundations are stable, expansion comes naturally.

Training also matters. People need to know not only how to use the tools but when not to use them. They should understand what data is permissible, what approval steps are required, and how to prompt for the best results. A short playbook and an internal policy can make a world of difference. The most effective teams treat the AI like a colleague. They know what it’s good at, when to ask for help, and when to take over.

Measuring Success

AI is a force multiplier. Success with AI is not about replacing people; it is about amplifying their impact. I’ve seen firms cut their DDQ turnaround time from weeks to 1-2 days while improving the quality of their answers. Investor letters arrive faster and read more consistently. Compliance teams see cleaner records and fewer version conflicts. Portfolio managers spend less time having to independently verify and format data and more time analyzing it. Those are meaningful wins.

Failure, on the other hand, usually looks like fragmentation. It happens when different departments use different tools, store answers in private chats, or maintain shadow spreadsheets that drift away from the truth. That kind of patchwork results in a scenario worse than using nothing at all - it creates risk and erodes confidence. Sustainable success requires a single framework, with data, process, people, and technology all aligned.

Looking Ahead

The forces driving this transformation are not slowing down. Investors will keep asking for more transparency, faster answers, and higher standards of communication. The firms that thrive will be those that combine a solid data foundation with a domain-aware AI layer and a culture of careful human oversight. It is a partnership of people and technology, not a contest between them.

For managers of all sizes, this means greater efficiency and productivity. For smaller managers, the technology can enable them to punch above their weight and compete with much larger, better-resourced competitors. With the right systems and discipline, they can meet or even exceed the communication standards of much larger firms. For large managers, the opportunity is to scale excellence and redeploy talent from repetitive tasks to higher-value work. AI will not tell our story for us. But it can clear the path so that our story reaches investors faster, more clearly, and with the confidence that every answer rests on solid ground.