Rewriting the Playbook: How AI is Driving Revenue, Efficiency, and Strategic Focus in Asset Management

Rewriting the Playbook: How AI is Driving Revenue, Efficiency, and Strategic Focus in Asset Management

The financial services industry continues to grapple with the burdens of operational and investment due diligence—an area increasingly marked by volume, complexity, and manual overhead. Both allocators (LPs) and asset managers (GPs) feel the pressure, but for asset managers in particular, the rising tide of DDQs (due diligence questionnaires) and RFPs (requests for proposals) has exposed significant limitations in legacy workflows.

Traditionally, due diligence and RFP response processes have been labor-intensive and siloed. Highly skilled professionals—Investor Relations, Client Service, Business Development, Compliance—spend countless hours locating previous answers, tailoring content, chasing internal approvals, and formatting submissions. All the while, having to worry about whether responses reflect the most recent information and are internally consistent. This is not only resource-draining but also strategically limiting. Many firms, despite their product strength and market reputation, are unable to respond to every inbound request simply due to bandwidth constraints.

This is where AI-powered solutions are changing the game.

Rather than merely “streamlining” workflows or automating a few repetitive steps, AI-native platforms are redefining how asset managers approach due diligence responses. These platforms do more than reduce workload—they unlock capacity, sharpen strategic focus, and directly impact both revenue growth and cost efficiency.

A Shift from Bottleneck to Business Enablement

Consider two real-world examples, shared by senior executives across different segments of the asset management ecosystem.

The Chief Operating Officer of a $5 billion private credit fund shared a common frustration: “We don’t participate in all the RFPs we receive because of bandwidth constraints. These RFPs just take too long to answer the way we need to answer.” So ultimately, high-friction processes are costing the firm growth opportunities.

This sentiment was echoed by a senior IR executive at a $45 billion traditional asset manager with a decades-long reputation and a globally recognized product set. “We only respond to about 60% of the RFPs we receive,” he admitted. “And that’s frustrating—because we know we’re leaving value on the table.”

These are two firms with vastly different sizes, strategies, and operating structures. Yet their pain points are strikingly similar: the opportunity cost of inefficient diligence processes.

What unites them—and so many of their peers—is the recognition that manual response workflows are no longer sustainable. With increased regulatory scrutiny and a greater number of factors considered by investors, questionnaires are only getting longer and can come with greater risks. In a competitive environment where mandates are won or lost based on responsiveness, quality, and completeness of submissions, every unaddressed RFP is potentially lost revenue.

The Strategic Value of Efficiency

AI-powered platforms can reduce the repetitive, manual elements of the DDQ and RFP response process by more than 50%. From auto-populating responses based on past submissions to recommending high-confidence answers and streamlining internal collaboration, these solutions liberate teams to focus on value-added work—relationship-building, deeper analysis, and more thoughtful customization.

As one business development leader noted: “To the extent that you can take the heavy lifting off our plate, we can spend more time reaching out to LPs.” This isn’t about simply saving time—it’s about reallocating talent to high-impact activities that drive growth and strengthen partnerships.

Today, many senior-level professionals still spend hours copying and pasting answers, reformatting documents, or chasing content from internal stakeholders. That is time that could—and should—be spent advancing conversations with investors, preparing for meetings, or closing new mandates. With modern technology available, the industry is reaching a point where this status quo is no longer just inefficient; it’s a strategic liability.

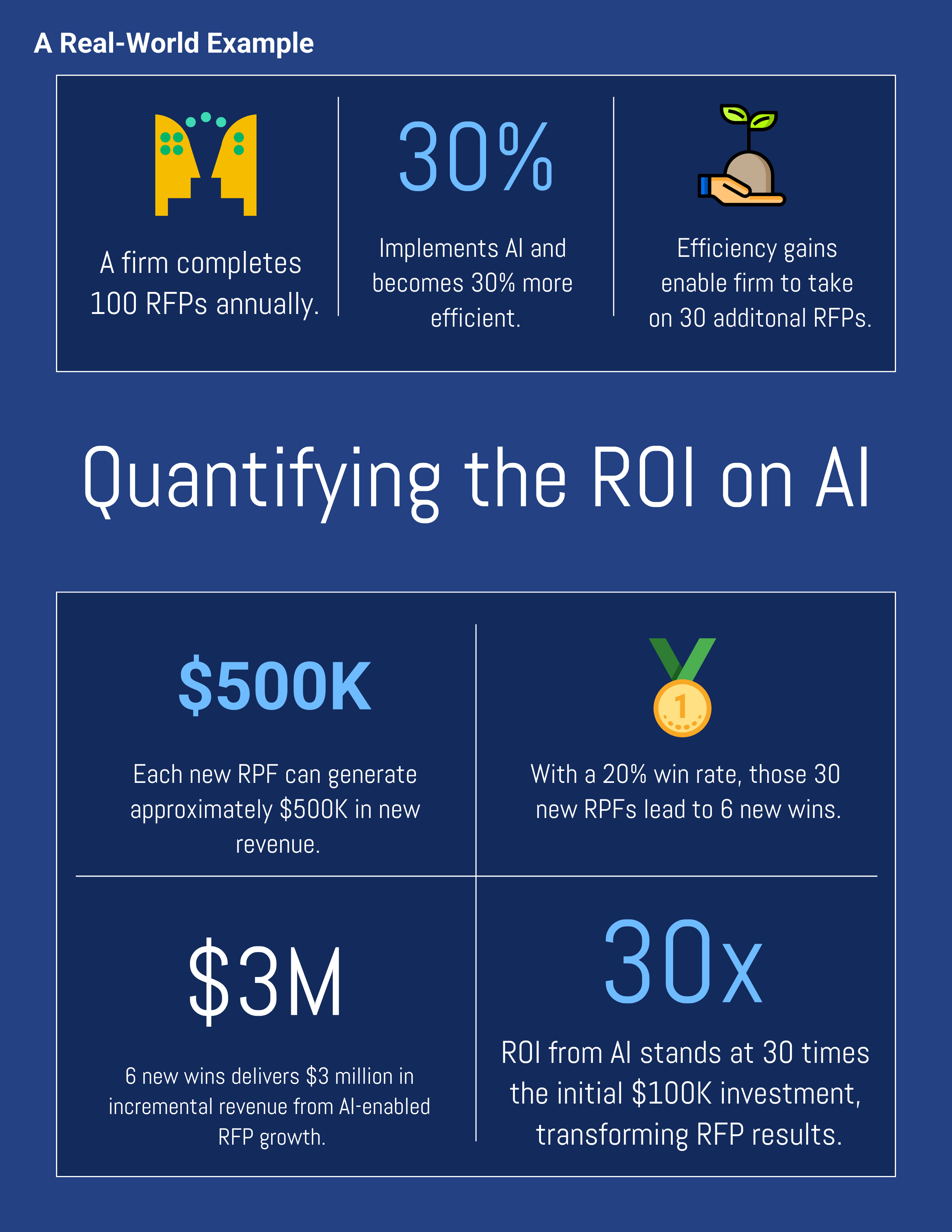

Quantifying the ROI: A Tangible Example

To truly understand the impact of these platforms, firms need to look beyond the operational metrics and consider the revenue implications. One example, shared at the 2025 FRA Conference in New York, outlined a simple but powerful business case.

This calculation reframes efficiency beyond the internal benefit; it is a clear investment in growth with a highly compelling ROI. For firms that have historically limited participation due to capacity constraints, technology becomes a force multiplier.

A Solution for All Sizes

Whether you’re a boutique fund with less than $5 billion in AUM or a global multi-strategy firm managing over $100 billion, the business case holds—though the scale may vary. Smaller firms often operate with leaner teams, meaning the time savings and automation can have an outsized impact on output capacity and responsiveness. Larger firms gain by greater coordination across complex, often global teams, ensuring consistency in responses and eliminating duplicative effort across product lines or regions.

In both cases, AI is not just helping teams “do more with less”—it is enabling a strategic reallocation of resources, aligning internal effort with external growth potential.

Looking Ahead: From Early Adoption to Standard Practice

We are still in the early stages of AI adoption in DDQ and RFP workflows. Most firms exploring or implementing these tools have done so within the past 12–18 months. Yet already, early adopters are seeing tangible results. A 30% efficiency improvement today may be a competitive advantage—tomorrow, it will be the baseline.

The industry is moving toward a future where not responding to 100% of qualified inbound opportunities is unacceptable. As comfort with AI-powered solutions increases and integrations become more seamless, firms that fully leverage these tools will differentiate themselves not only operationally, but commercially.

My Final Thoughts

Due diligence and RFP response have long been viewed as necessary but resource-heavy components of doing business in asset management. But with the emergence of purpose-built AI solutions, these functions are being reimagined—not just for efficiency, but for strategic advantage. At the end of the day, every client interaction is a marketing opportunity to tell your story in the best possible light.

For executives seeking to reduce friction, boost win rates, and unlock revenue potential, now is the time to evaluate the tools available. Because in today’s market, responding smarter isn’t optional—it’s essential.