What is Bank Network Management?

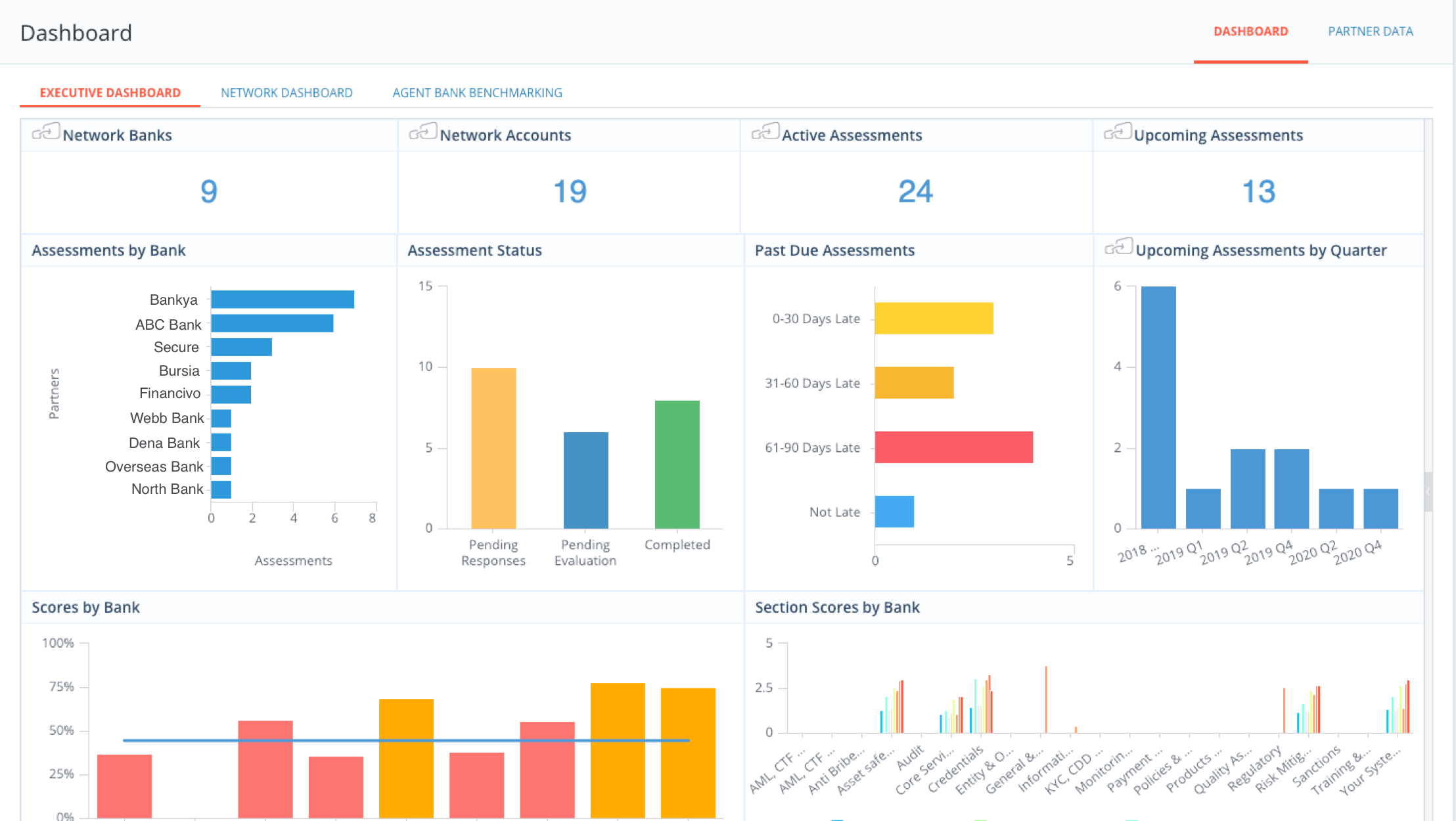

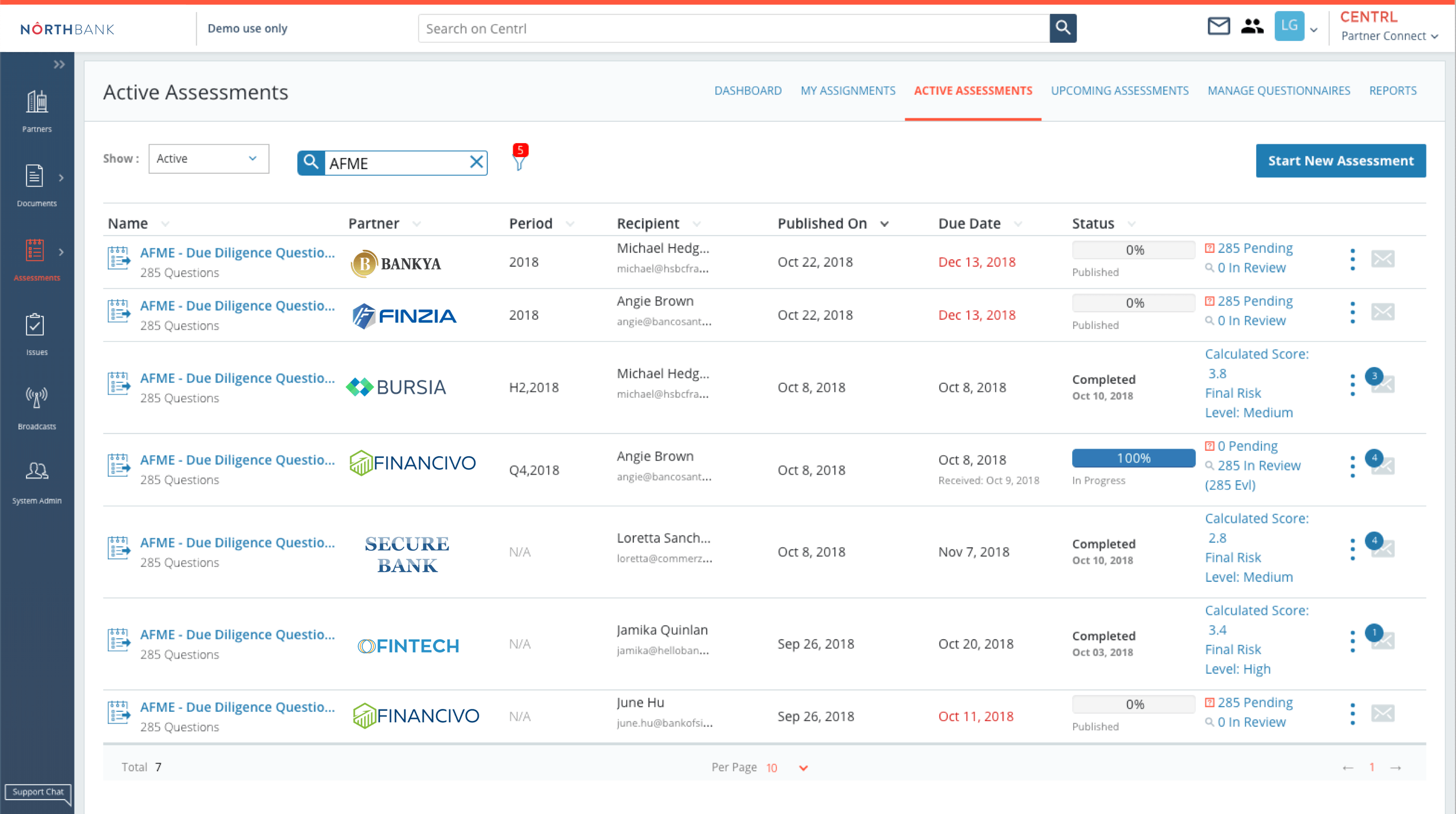

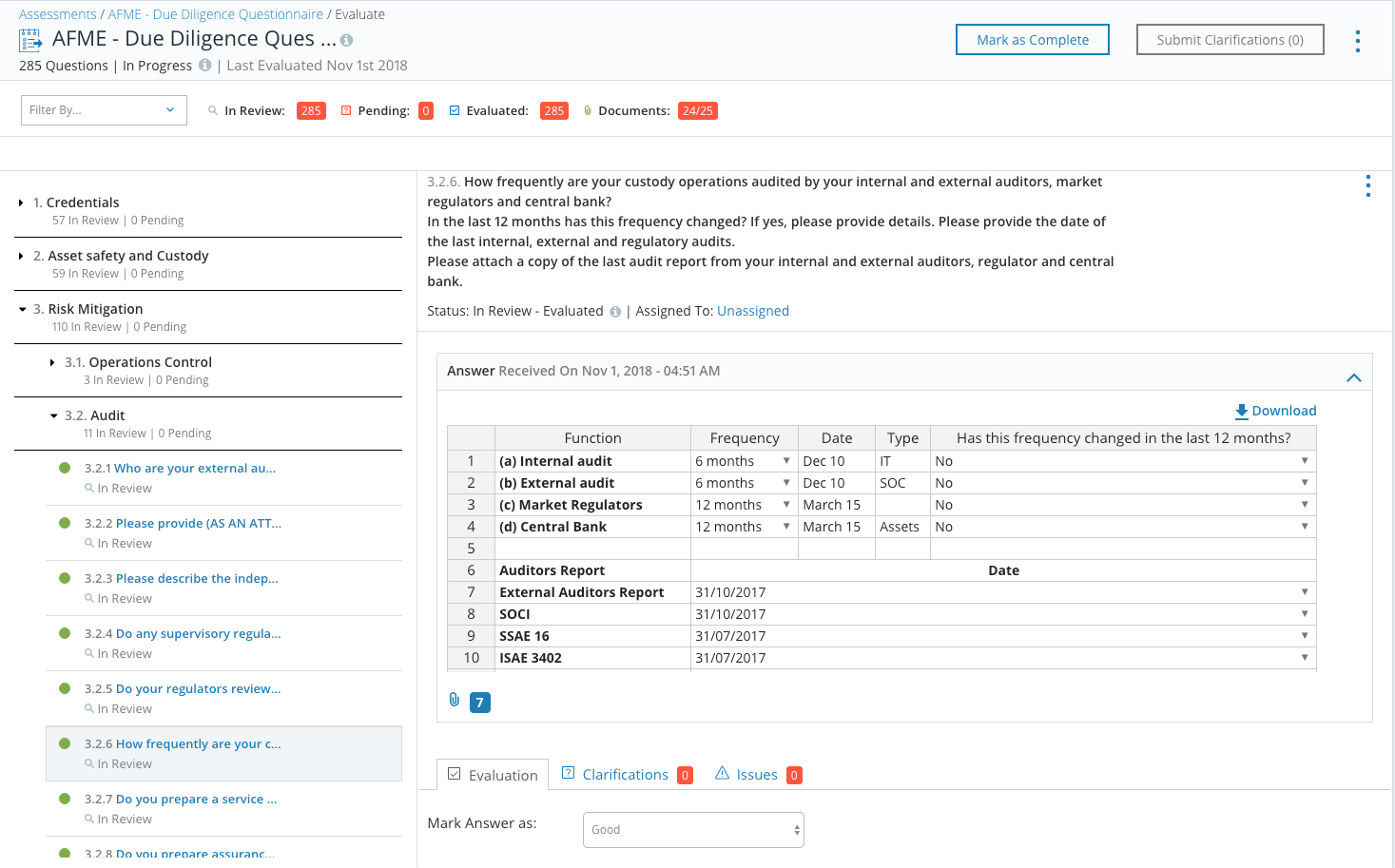

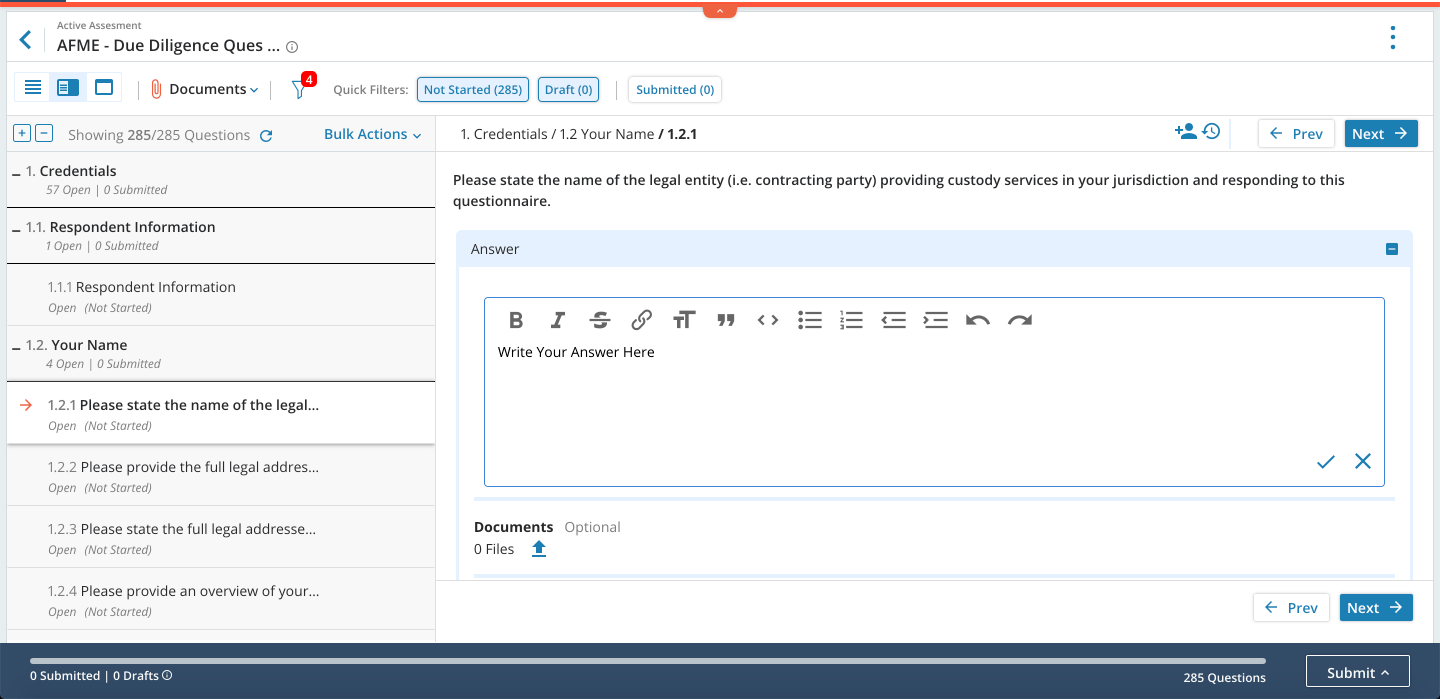

Bank Network Managers with the responsibility of monitoring the risk of hundreds of agent banks recognize the urgent need for automating the process to improve efficiency and strengthen risk management. The current manual and fragmented process is highly inefficient and tedious for both custody managers and agent banks.